Not known Details About Property By Helander Llc

Not known Details About Property By Helander Llc

Blog Article

Some Ideas on Property By Helander Llc You Need To Know

Table of ContentsWhat Does Property By Helander Llc Do?Getting My Property By Helander Llc To WorkExcitement About Property By Helander Llc7 Simple Techniques For Property By Helander LlcWhat Does Property By Helander Llc Mean?How Property By Helander Llc can Save You Time, Stress, and Money.

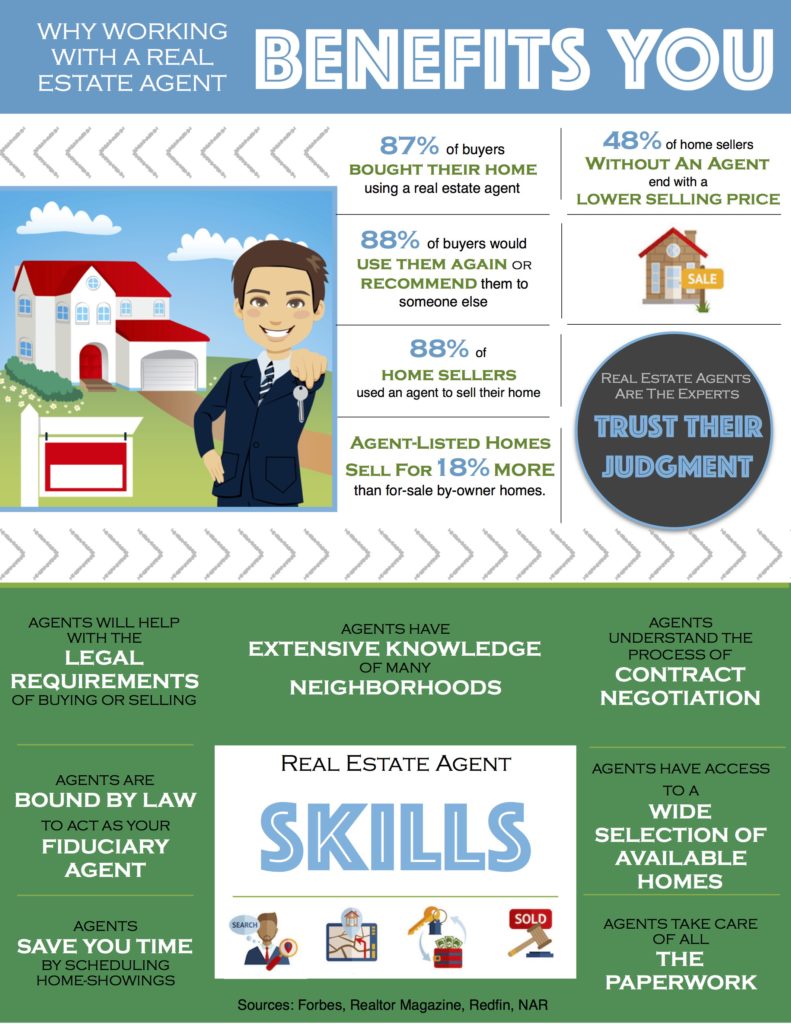

The advantages of investing in real estate are various. Here's what you need to recognize concerning actual estate advantages and why genuine estate is taken into consideration a great investment.The advantages of investing in genuine estate include easy revenue, secure money flow, tax obligation benefits, diversity, and take advantage of. Actual estate investment counts on (REITs) provide a method to invest in real estate without having to own, operate, or financing residential properties.

In most cases, capital just enhances in time as you pay for your mortgageand develop your equity. Actual estate capitalists can make the most of many tax obligation breaks and deductions that can save money at tax obligation time. In basic, you can subtract the affordable expenses of owning, operating, and managing a home.

The 2-Minute Rule for Property By Helander Llc

Property worths have a tendency to raise gradually, and with an excellent financial investment, you can make a profit when it's time to offer. Leas also tend to climb gradually, which can bring about greater cash money circulation. This graph from the Federal Book Bank of St. Louis shows average home costs in the united state

The areas shaded in grey show united state recessions. Average List Prices of Houses Offered for the United States. As you pay down a residential or commercial property mortgage, you construct equityan possession that becomes part of your web worth. And as you construct equity, you have the take advantage of to purchase more homes and increase capital and riches also extra.

Because property is a substantial property and one that can serve as security, funding is easily offered. Actual estate returns vary, depending on variables such as location, property class, and administration. Still, a number that several capitalists aim for is to beat the average returns of the S&P 500what many individuals describe when they claim, "the marketplace." The rising cost of living hedging capability of property originates from the positive partnership in between GDP development and the demand for genuine estate.

The Property By Helander Llc Diaries

This, in turn, translates into greater capital worths. Genuine estate has a tendency to preserve the buying power of resources by passing some of the inflationary pressure on to tenants and by incorporating some of the inflationary stress in the form of funding gratitude - Sandpoint Idaho land for sale.

Indirect real estate spending includes no straight ownership of a building or properties. There are a number of methods that having real estate can secure versus inflation.

Finally, properties funded with a fixed-rate financing will certainly see the family member amount of the month-to-month mortgage repayments tip over time-- for instance $1,000 a month as a fixed payment will end up being less burdensome as inflation erodes the acquiring power of that $1,000. Often, a main residence is ruled out to be a realty investment because it is made use of as one's home

A Biased View of Property By Helander Llc

Even with the assistance of a broker, it can take a few weeks of work just to find the ideal counterparty. Still, realty is a distinctive property class that's straightforward to understand and can boost the risk-and-return account of a capitalist's portfolio. By itself, realty uses money flow, tax breaks, equity building, competitive risk-adjusted returns, and a bush versus rising cost of living.

Purchasing property can be an incredibly fulfilling and profitable undertaking, yet if you're like a whole lot of new investors, you may be questioning WHY you ought to be spending in realty and what advantages it brings over various other financial investment possibilities. In enhancement to all the amazing benefits that occur with spending in actual estate, there are some drawbacks you need to consider too.

Not known Factual Statements About Property By Helander Llc

If you're looking for a method to buy into the property market without needing to spend numerous hundreds of bucks, take a look at our residential or commercial properties. At BuyProperly, we utilize a fractional possession version that allows financiers to start with as little as $2500. An additional significant benefit of realty investing is the ability to make a high return from purchasing, refurbishing, and reselling (a.k.a.

The Basic Principles Of Property By Helander Llc

As an example, if you are billing $2,000 rent per month and you incurred $1,500 in tax-deductible costs monthly, you will just be paying tax on that particular $500 revenue each month. That's a huge distinction from paying tax obligations on $2,000 per month. The profit that you make on your rental for the year is taken into consideration rental revenue and will be exhausted appropriately

Report this page